Through interactions with luminaries from distinguished backgrounds, the Symbiosis Institute of Business Management (SIBM) in Pune aims to nurture the intellectual capital of the student body.

The Research and Scholastic Development Team (RSDT) of SIBM Pune organized its annual flagship event 'Budget Symposium' in a virtual format. The event was held on the 6th of February 2022, and the theme for this year's event was "A Booster Shot to Equitable Growth."

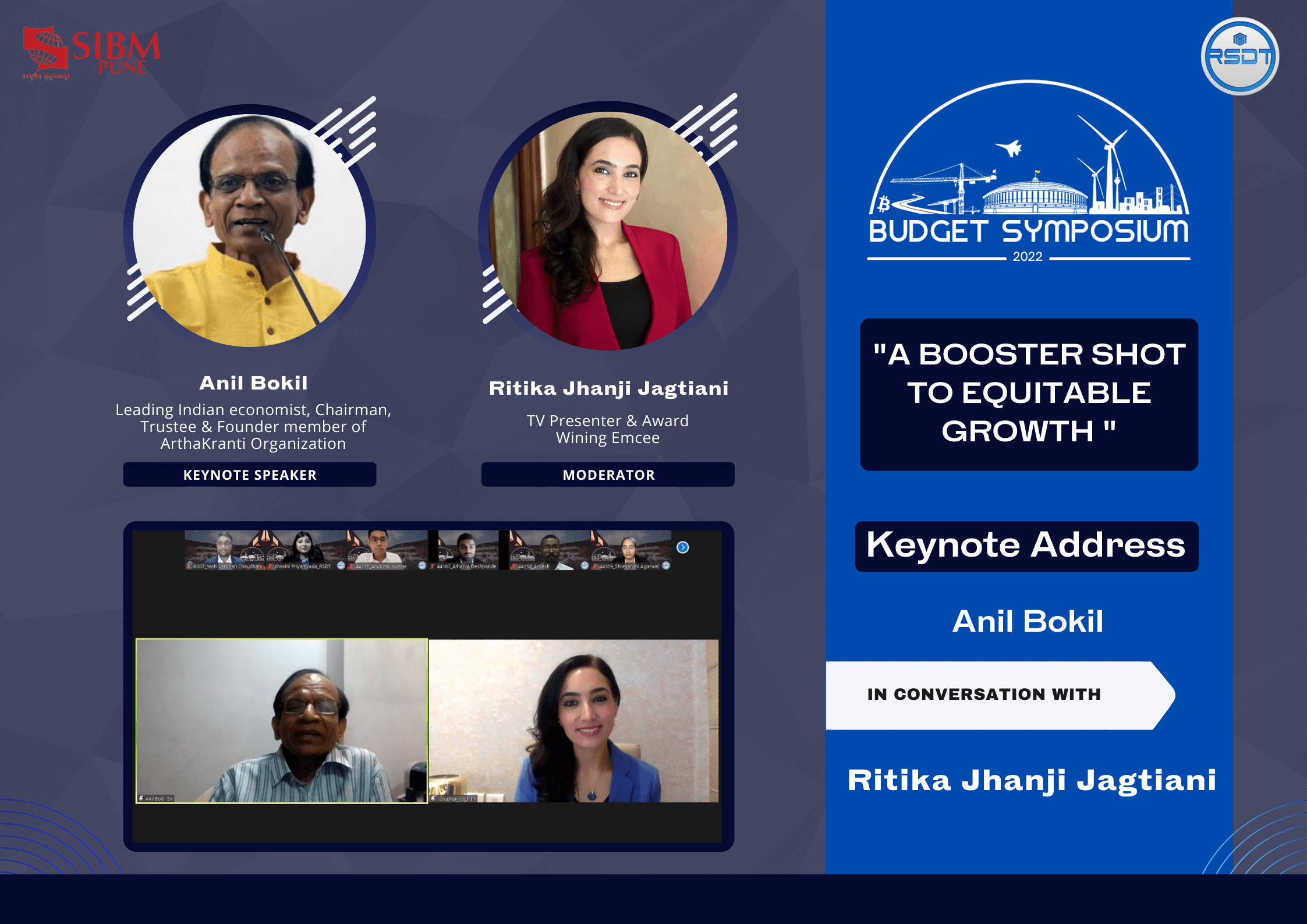

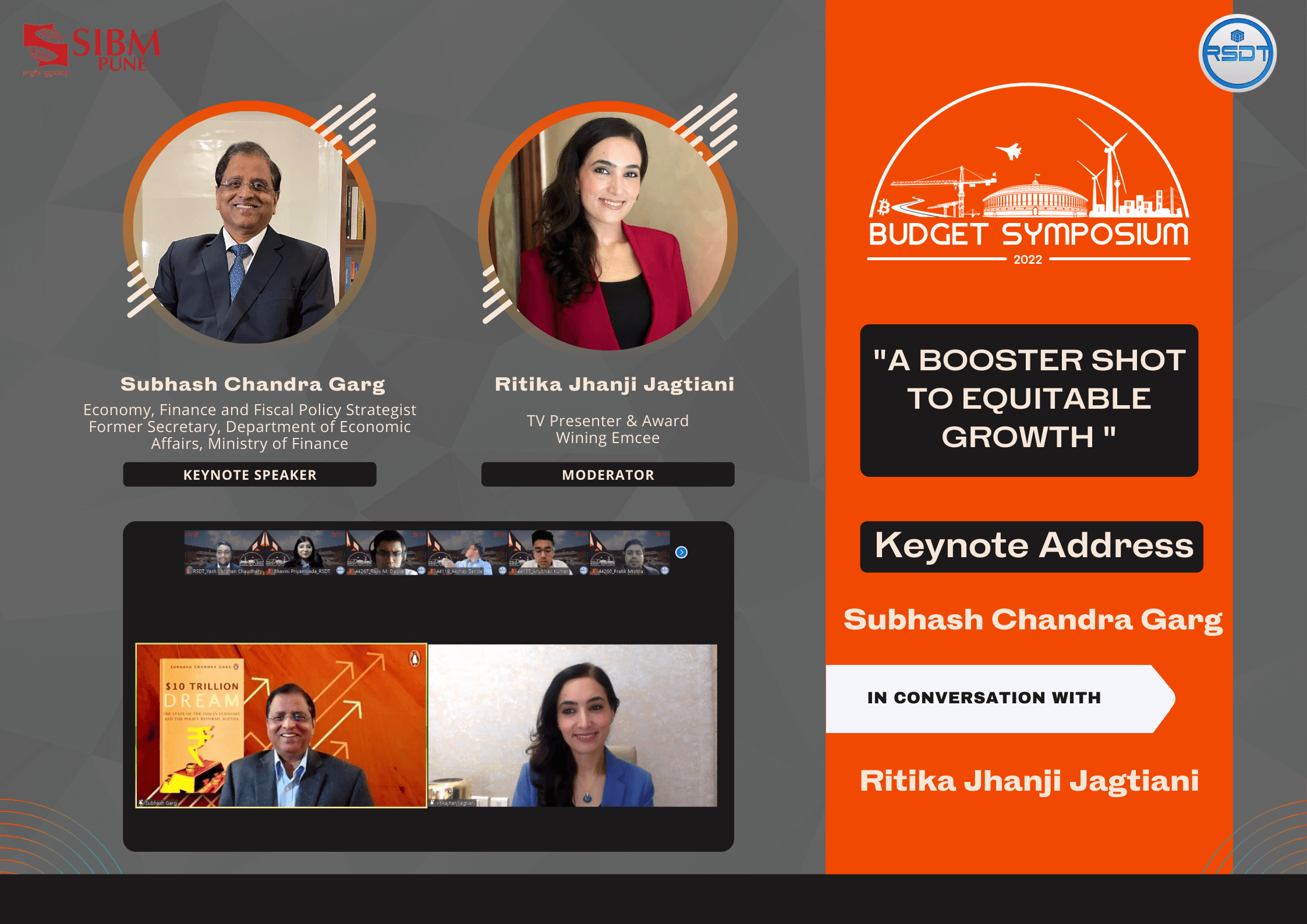

The curtain-raiser to the event was an enriching keynote session on the Union Budget by Mr Subhash Chandra Garg, Economy, Finance and Fiscal Policy Strategist, Former Secretary, Department of Economic Affairs, Ministry of Finance, followed by a Q&A session moderated by Ms Ritika Jhanji Jagtiani, TV Presenter & Award-Winning Emcee. The second session was graced by Mr Anil Bokil, Indian Economist, Chairman, Trustee & Founder ArthaKranti Organization, in conversation with Ms Ritika Jhanji Jagtiani, providing a different perspective to the Union Budget 2022-23.

This was followed by an illuminative panel discussion with industry stalwarts, including Qualified Fellow Chartered Accountant Mr Abhishek Gupta, Founder, Starter's CFO; Dr Anil Kumar, Independent Director, LIC India and Professor, Department of Commerce, SRCC, University of Delhi; Ms Kanika Pasricha, Economist, Standard Chartered Bank, India; Ms Mitali Nikore Consultant Economist, World Bank and Founder, Nikore Associates and Ms Lekha S. Chakraborty Professor, National Institute of Public Finance and Policy and Member, Governing Board of Management, International Institute of Public Finance (IIPF) Munich.

The panel was moderated by Ms Amruta Shedge, journalist and columnist. The experts on the panel expressed their views on topics like health, agriculture, defense and financial markets.

The discussion correctly focused on the benefits and drawbacks of the federal budget and how it sets the tone for the next "25 years," as our Finance Minister had correctly stated. The panel expressed views on the Union Budget 22 as a clear budget that laid out a blueprint for areas such as infrastructure, digitalization, education and health. The panel stated the budget would be growth supportive and in sync with the fiscal policy with CAPEX investment policies, allowing the government to spend more, tackle uneven recovery, and help the MSME sector boost employment. Impacts of no change in tax slab rate, the inclusion of mental health, tax exemptions for start-ups, taxation on virtual assets and 100 channels to support virtual education were also discussed. The enriching session helped the students envision the trajectory set by the Union Budget for the contemporary economic scenario.

The panel believed that the newer regimes would assist India in controlling its budget imbalance and moving forward towards a better future. While the session was held online, it was thought-provoking and aided the students' knowledge of the budget.